Written By: Ntombi Ndaba

The value of the rand, like any commodity is determined by the market forces of supply and demand; the higher the demand of a currency relative to another determines its real value and real purchasing power. With the rand strengthening, as a young professional one can’t help but get excited at the opportunities presented to us to take advantage of…

Since December 2017 ANC conference where Cyril Ramaphosa succeeded former president Jacob Zuma as the president of the ANC, the rand strengthened by approximately 4% against the USD from the day of the conference making it the best performing emerging markets currency at the time. It has maintained its performance even after the official appointment of Mr Cyril Ramaphosa as president of the Republic of South Africa despite the weakening US dollar.

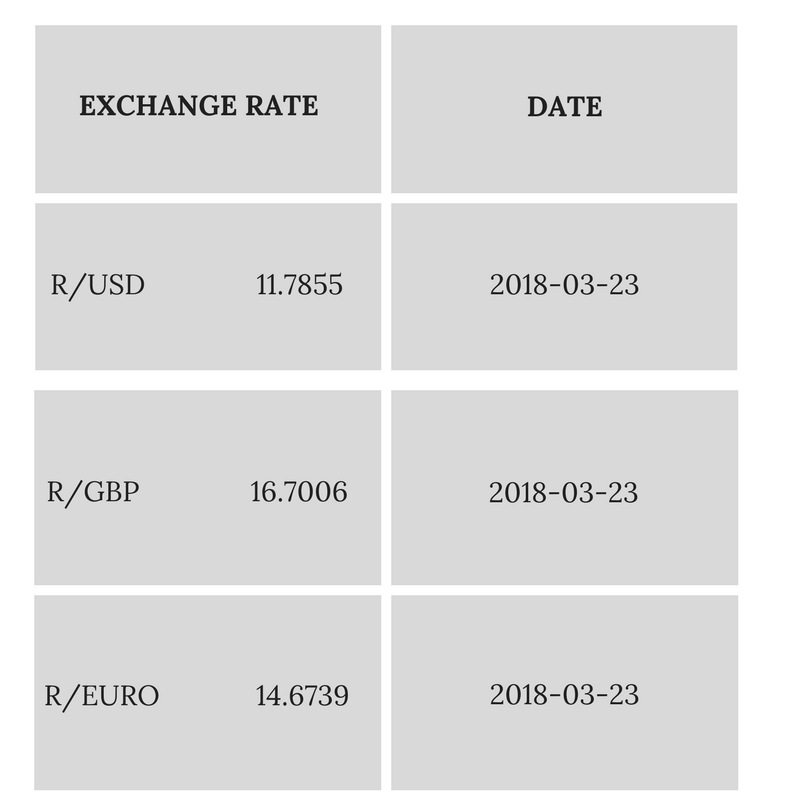

As seen below, the latest data reflects its current states against the other EM currencies; R11.78 against the US dollar, R16.70 against the British Pound and R14.67 against the Euro.

Data extracted from the SARB website at 23 March 2018

It has been a while since South Africa has seen its currency rise especially since the last cabinet reshuffle by former President Jacob Zuma, where he removed Finance Minister Nhlanhla Nene from his seat to replace him with David Van Rooyen. This saw the rand take a dip in the longest streak of losses since November 2013; stocks fell and bond prices spiralled down the most on record as the markets and it’s people plunged into ‘shock mode’, buried in anxiety of what was to come next.

Fortunately, the rand slowly recovered despite the political strife the country faced at the time. With that said, it brings to mind a number of opportunities presented to the millennials looking to maximise on this opportunity and the following comes to mind:

Buy foreign currency and Save it!

As depicted in the image above extracted from the South African Reserve Bank, currencies are trading in low currently and it’s uncertain how long this will last. Therefore, a good start would be to invest in foreign currency- just buy, save and wait for the inevitable day of when they regain their momentum or for the unfortunate (fortunate for some) event that the rand weakens again.

![]()

Travel overseas

There are many travelling specials popping up on every social media platform right now. I found a great site for Rand-favorable destinations called “TravelStart”.

It provides the destinations and booking tools for one to do live quotes on and also compare your currency to that of your vacation destination’s choice. With the now stronger Rand, one can travel to destinations such as:

- Philippines; known for its rich mix of people and histories

Exchange rate: R1 is equal to 3 Philippine pesos, so you can budget around R625 per day for a dorm bed or a single room, local food for lunch and dinner, a drink and a tricycle ride.

- Bali; which has volcanos to climb, street food, monkey sanctuaries, elephant rides etc.

Exchange rate: R1 = 841 IDR.

Expenses: budget about R870 for a basic budget day of food, accommodation and transport.

- Thailand (the people’s favorite); known for its beautiful culture and breathtaking islands.

Exchange rate currently: R1 = 2.2 Thai Baht.

Expenses: Perhaps budget about R440 per day for a basic guest house room

- Vietnam; knowns for its delicious street food.

Exchange rate: R1 = 1,428 Vietnamese dong.

Expenses: Budget about R312 per day for budget accommodation, street food and cheap public transport on scooters and buses.

![]()

Import

For those in the consumer goods market space, one can purchase several foreign goods – from household items, clothing, shoes, sewing materials, equipment, good quality hair extensions or any other products for resale or remake depending on the line of business you are in.

For example, in 2016 a pair of socks in China was selling for $0.99 cents which was R14.00 at the beginning of the year; now you can buy them for R2.00 less than it was previously. Additionally, for an ordinary shopper looking to do online shopping this is good news, as what you will pay now versus last year has a material difference.

It does get tricky when the inflation rate is high though, however, fortunately when the inflation numbers came in on the 22nd March 2017 they were slightly better than expected: the inflation rate on a month-on-month basis came in at 1.1% and economists expected it to be around 1.2% indicating that there is real purchasing power to the ZAR currently when we look at it in real terms. The exchange rate has remained the same since the last update.

![]()

Send money offshore using your investment allowances

All South African citizens over the age of 18 may be able to send money overseas (or ‘offshore’ as its known), limited to R11 million per year. Fortunately, the first million doesn’t require tax clearance from SARS; however the next 10 million you send will require you to obtain a tax clearance certificate. For young preofesionals still climbing the ranks in terms of their salary, being able to send any amount under R1million tax free is great news! It is important to seek advice before sending your money off to protect yourself from unforeseen losses and to ensure you actually profit from the investment, as well as protect yourself from any money laundering schemes or traps etc.

![]()

Withdraw your South African retirement fund

If you decide to leave the country, especially if permanently, you can withdraw your savings from your retirement fund and reinvest it or use it as you please in the country in which you will be based. The advantage of withdrawing your funds is that you will have certainty that your savings are not at the mercy of the ever-volatile rand. With the strong rand, it means you will be able to obtain funds from your savings especially if the currency of your chosen home is weaker than the rand. You can also pay off your bond and other debts and acquire new assets with the withdrawn retirement funds, and with a steady inflation rate it means your money will have more purchasing power and you can acquire valuable assets while abroad.

![]()

Buy property overseas

With the Rand currently trading at R16 against the British Pound, it would be a great time to invest in property right now. Although the yields from property are not always as high as equities or other riskier investments, they are usually greater. In the past, buying property offshore has been challenging for South Africans, but now things have changed. There is also the benefit of earning EU residency when you buy property in countries like Portugal, as there are plenty of benefits to working there, which can amounts to frequent travel for you and your family.

For more professional advice and a broader insight on this topic, contact your financial advisor.

WISH TO CONTRIBUTE OR SUBMIT AN ARTICLE TO TCC? CLICK HERE FOR MORE INFO ON SUBMISSIONS

Excellent article written by Ntombi Ndaba, insightful and can be tracked easily given the provided information. Looking forward to more

Thank you Kelly-Anne. We are definitely look forward to having more articles written by Ntombi !

Wow,this is such a great article.Very informative as well for us millenials.